Description

The trading strategy is simple. BUY or SELL position is opened and protected by a pending Stop order at a distance of Delta 1. Then, a grid consisting of Limit or Stop pending orders at a distance of Delta 2 from one another is created. The number of pending orders of each direction is set in Max Lines. Pending orders (Buy Limit, Sell Limit, Buy Stop and Sell Stop) are set via a single PendingOrder function, to which a pending order type (order_type), volume (volume), stop loss (sl) and take profit (tp) are passed

//+------------------------------------------------------------------+ //| Pending order | //+------------------------------------------------------------------+ void PendingOrder(ENUM_ORDER_TYPE order_type,double volume,double price,double sl,double tp) { sl=m_symbol.NormalizePrice(sl); tp=m_symbol.NormalizePrice(tp); if(m_trade.OrderOpen(m_symbol.Name(),order_type,volume,0.0, m_symbol.NormalizePrice(price),m_symbol.NormalizePrice(sl),m_symbol.NormalizePrice(tp))) { if(m_trade.ResultOrder()==0) { Print("#1 ",EnumToString(order_type)," -> false. Result Retcode: ",m_trade.ResultRetcode(), ", description of result: ",m_trade.ResultRetcodeDescription()); PrintResultTrade(m_trade,m_symbol); } else { Print("#2 ",EnumToString(order_type)," -> true. Result Retcode: ",m_trade.ResultRetcode(), ", description of result: ",m_trade.ResultRetcodeDescription()); PrintResultTrade(m_trade,m_symbol); } } else { Print("#3 ",EnumToString(order_type)," -> false. Result Retcode: ",m_trade.ResultRetcode(), ", description of result: ",m_trade.ResultRetcodeDescription()); PrintResultTrade(m_trade,m_symbol); } //--- }

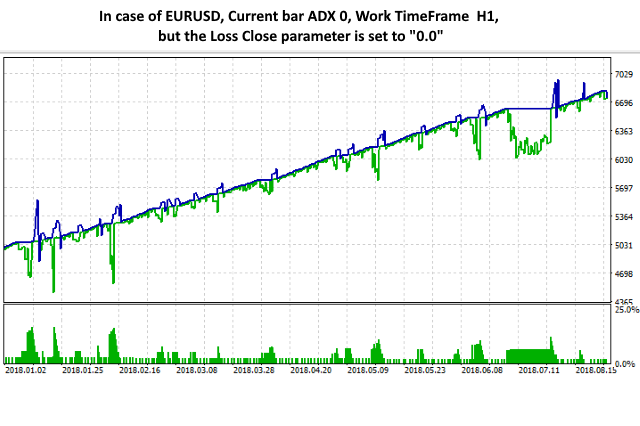

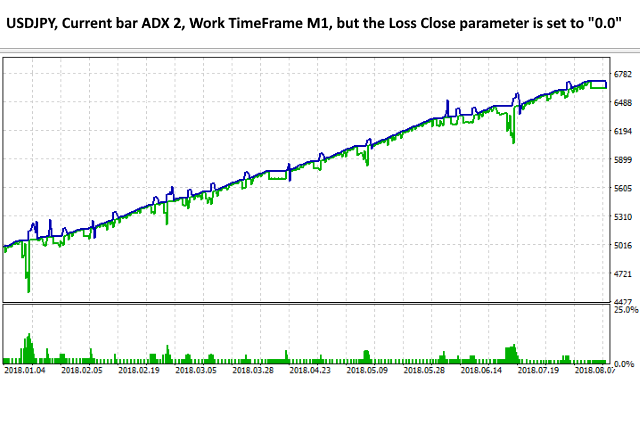

When reaching the Profit Close target profit, close all positions and remove all pending orders. You can also close all positions and delete pending orders if you lose more than Loss close (if you set Loss close to 0.0, the parameter is disabled).

The EA operation (opening positions and setting protective pending orders) is performed within the working time interval from Start hour to End hour (Start hour may be less than End hour or exceed it).

Main idea

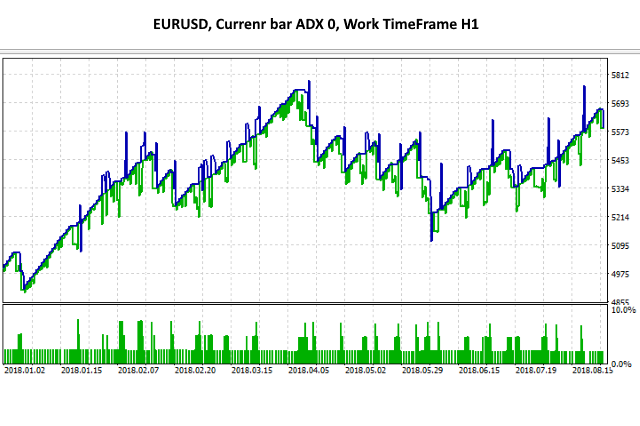

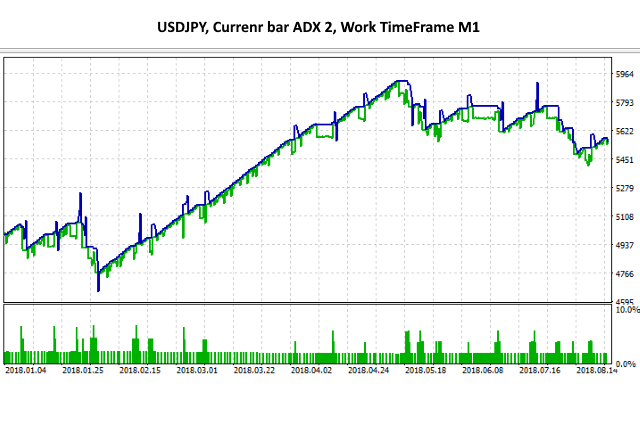

Analyzing ADX value on Work TimeFrame timeframe. If ADX is below 40, this is considered to be flat, and Limit pending orders are placed. Otherwise, Stop pending orders are used;

If DI+ is higher than DI-, buy, otherwise, sell.

The best optimization results of the two parameters (Current bar ADX from 0 to 2, step 1 and Work TimeFrame from M1 to H1)